Advertisements

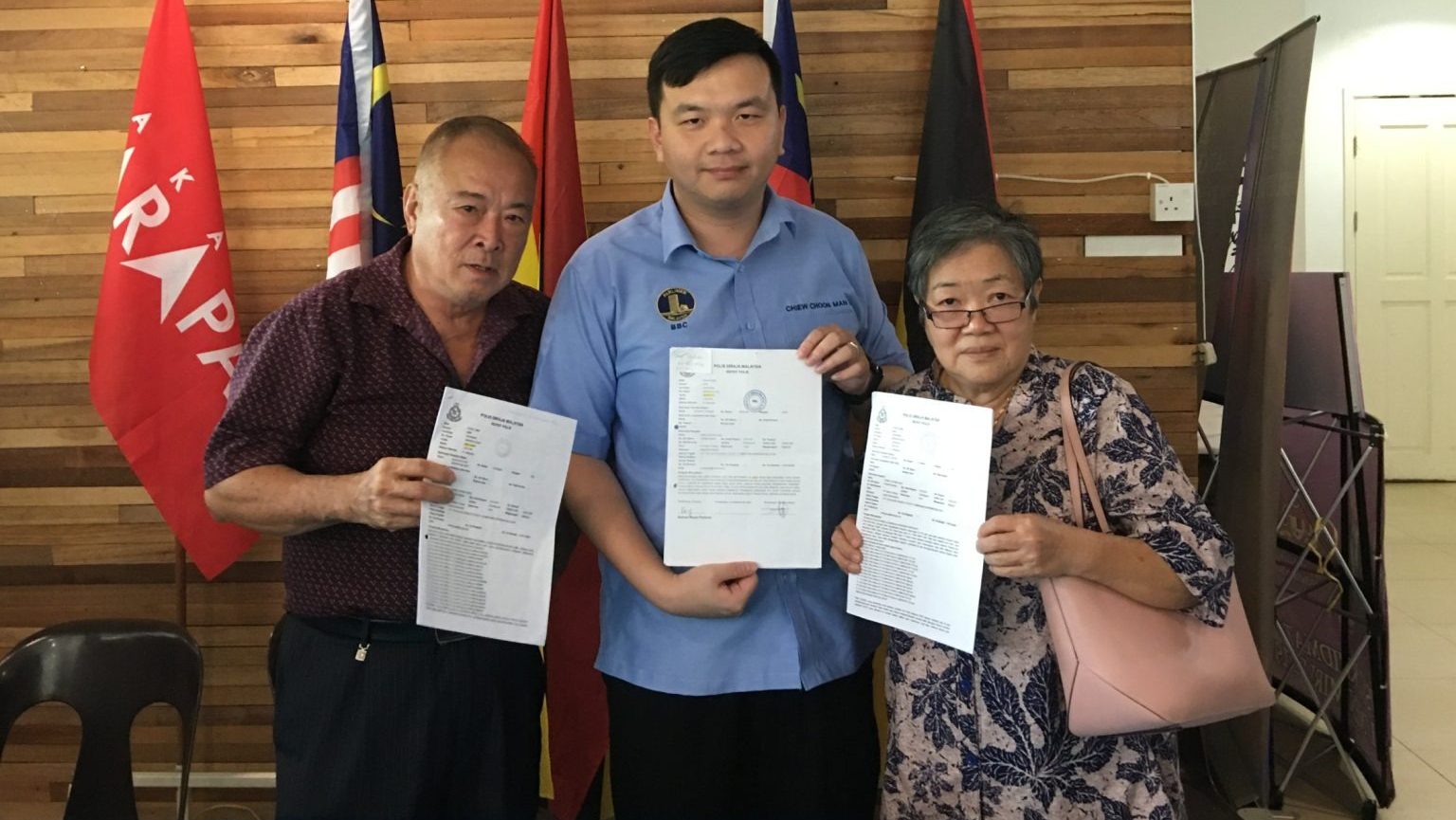

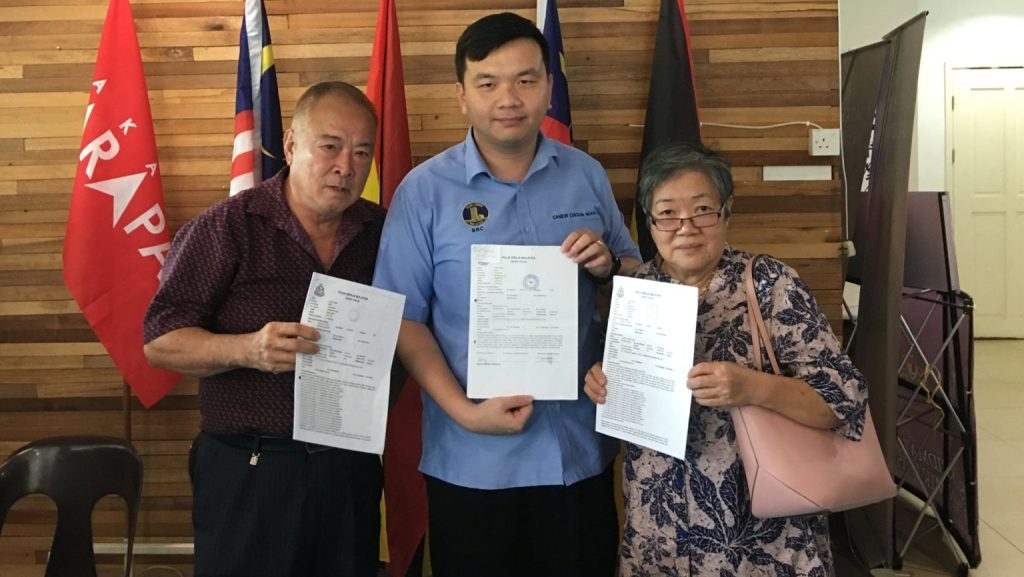

MIRI (Sept 10): An elderly couple in Miri has fallen victim to internet banking fraud, losing a staggering RM120,000 due to unauthorised transactions on their credit and debit cards between June and August this year. The incident has sparked concerns over the security of internet banking systems, prompting Miri MP Chiew Choon Man to call for stricter measures to prevent such occurrences.

Elderly Couple’s Ordeal with Fraudulent Transactions

Mr Lo and Mdm Kong, the victims of the fraudulent activity, reported the incidents to the police and sought assistance from their Member of Parliament, Chiew Choon Man. The couple’s nightmare began when Kong visited the Urban Transformation Centre (UTC) Miri on June 28 to renew her road tax but was unable to complete the payment as her credit card had reached its limit.

“Upon checking her bank statement, she discovered several unauthorised transactions on her Touch ‘n Go (TnG) account,” said Chiew during a press conference yesterday.

Advertisements

Further compounding their woes, Kong faced similar issues on July 30 when she attempted to pay for her insurance online using another credit card. Again, the payment could not be completed due to the card reaching its limit.

Multiple Unauthorised Transactions

Chiew explained that Mr Lo also became a victim of fraud when he received a call from his bank on August 6 regarding a RM5,000 transaction linked to a TnG account. Despite informing the bank that he had not authorised the transaction and requesting it be stopped, Lo found that the payment had still been processed.

“Upon checking his bank statement later, Lo found the unauthorised payment had gone through,” Chiew added.

On August 19, Kong attempted to use her debit card for an insurance payment but encountered the same issue—the card had exceeded its limit. When checking her bank statement, she discovered multiple unauthorised transactions, including another RM5,000 pending payment for a TnG account.

“Kong informed me that she had never made any such transactions and had no knowledge of how they occurred. However, when she contacted the bank, they told her that a Transaction Authorisation Code (TAC) had been sent to her phone for verification,” Chiew said.

Miri MP Calls for Stricter Security Measures

Chiew Choon Man has called on Bank Negara Malaysia to take immediate action to enhance internet banking security measures and prevent similar fraud cases from affecting more Malaysians, especially vulnerable groups like the elderly.

“There is no standardised operating procedure across banks when it comes to transaction authorisation. Some banks call to verify transactions, others send TAC numbers via SMS, and some require authorisation through their mobile app,” he highlighted.

Chiew expressed his concern that the lack of uniform security protocols among banks is a loophole that fraudsters are exploiting. He stressed the importance of implementing stricter measures and urged the federal government to standardise SOPs across all banking institutions.

Urgent Need for Government Intervention

Chiew announced his intention to raise this issue in the upcoming parliament session, urging the government to adopt more robust strategies to combat internet banking fraud. He emphasised the need for an industry-wide approach to safeguard customers’ financial data and transactions.

“The government must ensure that all banks follow a standard protocol when it comes to transaction authorisation to protect the public from falling victim to such fraudulent activities,” said Chiew.

Advice to the Public: Regularly Check Bank Statements

In the meantime, Mr Lo advised the public to stay vigilant by regularly checking their bank statements to detect any unauthorised transactions early.

“If you notice anything suspicious, take immediate action by contacting your bank and filing a police report,” Lo urged.

Focus on Internet Banking Security

As cases of internet banking fraud continue to rise, it is crucial for both the authorities and banking institutions to prioritise customer safety and enhance security measures. The incident involving Mr Lo and Mdm Kong serves as a stark reminder of the vulnerabilities in the current banking system and the urgent need for comprehensive solutions.